property, plant and equipment represent the single largest investment any company makes in its operations. Understanding the performance to invest in fixed assets and generate sales from them can be possible by calculating the fixed asset ratio.Fixed assets i.e. Final wordsĮvery company holds some fixed assets that indicate its profit and loss after each accounting year. It can be due to the non-availability of funds, enough depreciation of machines, and the substantial reduction of a net block. It tells that your company utilizes fixed assets well to generate revenue, but the investments are low. On the other hand, a higher fixed asset turnover ratio is better for many businesses. You may have low asset utilization and high depreciation cost, which is not a good indication. Your company's management should pay attention to it otherwise, you may face future losses.

With a lower ratio, you should know that your investments in fixed assets are more, but your sales performance is low. The decisions should be mutual, made after analyzing these factors deeply and based on essential financial indicators. The management team of a company holds critical decisions regarding assets and investments. Factors like capital-intensive industry, type, demand, and supply of product, age and operational time of fixed assets, and others significantly impact the asset turnover ratio. The fixed asset turnover ratio is not the same for all companies, as many factors may affect it. You can attract and convince various investors and lenders to invest in your company with your high return on the capital, as it is a positive initiative for them. If your fixed assets turnover ratio is high, the return on your capital would also be high. What is a good fixed asset turnover ratio?Ī high fixed asset turnover indicates that a company is utilizing its fixed assets adequately and efficiently.

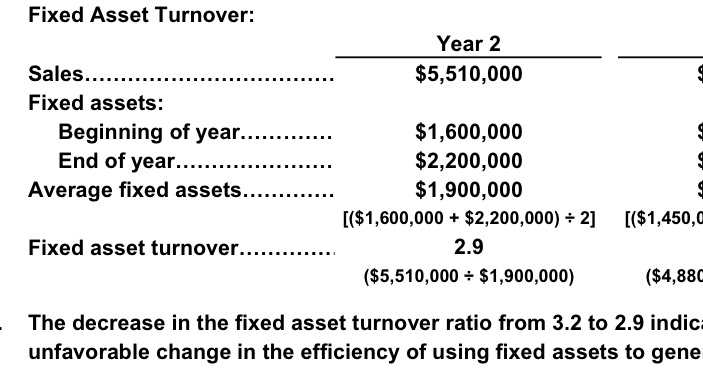

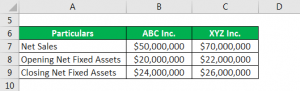

You can calculate net sales or net revenue by: It is presented on the income statements and annual reports of a company. Net revenue or net sales is the figure acquired after deducting all sales returns. The fixed asset turnover ratio is shown and calculated by the following equation: What is the formula for fixed asset turnover?

Investors with capital-intensive businesses are more likely to benefit from fixed asset turnover as it helps them calculate the profit they will get on investments. It will tell you whether your augmenting sales are more or less than your asset bases. It enables them to make crucial decisions regarding their investment plans.įixed asset turnover is valuable for analyzing the company's growth. What does fixed asset turnover tell you?įixed asset turnover helps lenders, investors, creditors, and management determine whether the business is growing well and using its fixed assets efficiently. Moreover, higher ratios can be risky as you ignore investment opportunities or sell off more of your fixed assets. A high turnover ratio indicates that a company uses a small number of fixed assets with highly developed sales. To get more about the fixed asset turnover ratio, its formula, calculation, and which ratio is a good indication, keep reading What is fixed asset turnover?įixed asset turnover, is an efficiency ratio that indicates your company's well or under-performance in generating sales.Ĭompanies can evaluate the efficiency of their management for investing in fixed assets. Here, the fixed asset turnover ratiof provides answer. It is impossible to determine a company's ability to invest and utilize fixed assets to generate net sales. Therefore, a company needs to track these investments and analyze whether it is generating sales and profit to justify its spending. Fixed assets, including property, equipment, and plant, represent a company's investment operations.

0 kommentar(er)

0 kommentar(er)